Contoh Perhitungan LEASING Mata Kuliah Manajemen Keuangan Lanjutan

Leasing :

The process by which a firm can obtain the use of certain fixed assets

for which it must make a series of contractual, periodic, tax deductible

payments

Lessee :

The receiver of the services of the assets under a lease contract

Lessor :

The owner of assets that are being leased

The process by which a firm can obtain the use of certain fixed assets

for which it must make a series of contractual, periodic, tax deductible

payments

Lessee :

The receiver of the services of the assets under a lease contract

Lessor :

The owner of assets that are being leased

Types of leases: Operating Lease

a cancelable contactual arrangement whereby the lessee agrees to

make periodic payments to the lessor, often for 5 or fewer years, to

obtain an asset's services; generally, the total payments over the term

of the lease are less than the lessor's initial cost of the leased asset.

Operating lease normally include maintenance clauses requiring the lessor

to maintain the asset and to make insurance and tax payments.

Renewal options, which grant lessees the right to re-lease assets at

expiration, are especially common in operating leases, because their term

is generally shorter than the usable life of the leased assets.

Purchasing option allowing the lessee to purchase the leased asset at

maturity, typically for a prespecified price, are frequently included in both

operating and financial lease.

Types of the leases: Financial (or Capital) Leases

A longer-term lease than an operating lease that is noncancelable and

obligates the lessee to make payments for the use of an asset over a

predefined period of time; the total payments over the term of the

lease are greater than the lessor's initial cost of the leased asset▪

Financial leases nearly always require the lessee to pay maintenace and

other cost.

Purchasing option allowing the lessee to purchase the leased asset at

maturity, typically for a prespecified price, are frequently included in both

operating and financial lease.

Leasing arrangements: Direct Lease

A lease under which a lessor owns or acquires the assets that are

leased to a given lessee

Leasing arrangements: Sale-Lease Back

A lease under which the lessee sells an asset for cash to a prospective

lessor and then leases back the same asset, making fixed periodic

payments for its use.

Leasing arrangements: Leverage Lease

A lease under which the lessor acts as an equity participant, supplying

only about 20% of the cost of the asset, while a lender supplies the

balance. Leverage leases have become especially popular in structuring

leases of very expensive assets.

The Lease-Versus-Purchase Decision

Step 1: find the after-tax cash outflows for each year under the lease

alternative

Step 2: find the after-tax cash outflows for each year under the

purchase alternative.

Step 3: calculate the present value of the cash outflow associated

with the lease (from step 1) and the purchase (from step 2)

alternatives using the after-tax cost of debt as the discount

rate.

Step 4: choose the alternative with the lower present value of cash

outflows from step 3. It will be the least-cost financing

alternative.

Case: Roberts Company, a small machine shop, is contemplating

acquiring a new machine that costs $24,000. Arrangement can be

made to lease or purchase the machine. The firm is in 40% tax bracket.

Lease; The firm would obtain a 5-year lease acquiring annual end-of-

year lease payment of $6,000. All maintenance costs would be paid

by the lessor, and insurance and other costs would be borne by the

lessee. The lessee would excercise its option to purcase the machine

for $4,000 at termination of the lease.

Purchase; The firm would finance the purchase of the machine with a

9%, 5-year loan requiring end-of-year installment payment of $6,170.

The machine would be depreciated under MACRS using a 5-year

recovery period. The firm would pay $1,500 per year for a service

contract that covers all maintenance costs; insurance and other costs

would be borne by the firm. The firm plans to keep the machine and

use it beyond its 5-year recovery period.

Notes: MACRS 5-year recovery period depreciation percentages is: 20% in

year 1, 32% in year 2, 19% in year 3, and 12% in years 4 and 5.

ANSWER :

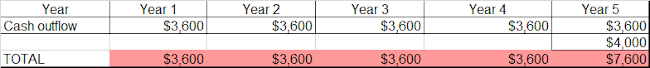

STEP 1

After-tax cash outflow from lease = $6,000 X (1-0.40) = $3,600

STEP 2

mencari angsuran bulanan beserta tabel amortisasi dengan cara yang sudah dibahas sebelumnya https://injilia-mikha.blogspot.com/2020/09/contoh-soal-perhitungan-bank-loan-mata.html

Contoh Soal kedua :

Case: Roberts Company, a small machine shop, is contemplating

acquiring a new machine that costs $24,000. Arrangement can be

made to lease or purchase the machine. The firm is in 25% tax bracket.

Lease; The firm would obtain a 5-year lease acquiring annual end-of-

year lease payment of $6,500. All maintenance costs would be paid

by the lessor, and insurance and other costs would be borne by the

lessee. The lessee would excercise its option to purcase the machine

for $4,000 at termination of the lease.

Purchase; The firm would finance the purchase of the machine with a

8%, 5-year loan requiring end-of-year installment payment of $6,010,955

The machine would be depreciated by using a 5-year straight line methods.

recovery period. The firm would pay $1,500 per year for a service

contract that covers all maintenance costs; insurance and other costs

would be borne by the firm. The firm plans to keep the machine and

use it beyond its 5-year recovery period.

ANSWER :

After-tax cash outflow from lease = $6.500 X (1-0.25) = $4.872

dari soal diatas dinyatakan bahwa penyewa akan menerapkan opsi untuk membeli mesin tersebut seharga $4000 pada saat sewa berakhir sehingga :

untuk depresiasi menggunakan metode garis luru selama 5 tahun dan tidak ada nilai jual diakhir tahun dengan perhitungan depresiasi :

depresiasi = 24.000/5

= 4.800

Maintenance cost sebesar 1,500 didapat dari soal

Interest PMT diambil dari tabel amortisasi

dari hasil tersebut kita dapat membandingkan menggunakan leasing atau pinjama bank dengan cara seperti pada tabel dibawah :

Thank you ;-)

Komentar

Posting Komentar